MARCH 3, 2026 VOTER GUIDE

Early Voting: Tuesday, Feb. 17th - Friday, Feb. 27th

Election Day: March 3rd

This is the March 2026 Democratic Primary San Antonio Democratic Socialists of America (SADSA) Voters Guide. There are no SADSA-endorsed candidates on the ballot this cycle.

Several community members have reached out to SADSA for a voter guide, so we created one. It is by no means expansive and does not cover every race in our area, but we hope this can help inform your decisions if you’re looking to a socialist organization for electoral advice.

All candidates named in this guide are recommended, and San Antonio DSA has not actively campaigned on their behalf. Candidates and propositions must seek the endorsement of SADSA, as our general membership votes on the decision to endorse.

Our struggles go beyond the ballot box, but it is a site of struggle that we cannot withdraw from or ignore. We can take it back if we fight together.

If you have any questions or comments, please email SanAntonioDSA@gmail.com.

Voters registered in Bexar County can vote at any Bexar County polling center. Visit the Bexar Co. Elections Department website to find voting locations, hours, your individual sample ballot, and more.

Quick Links

U.S. SENATE

No Recommendation

Background: Neither of these candidates is anywhere close to where we would like them to be, but that’s life in the DSA, baby.

State Representative James Talarico is/has been a moderate on many issues. This cycle, his entire campaign messaging is about how bad billionaires are and waging class warfare…which is cool coming from a Texas Democrat, but it also seems like it's coming out of nowhere? He didn’t talk much about that when he was in the Texas House.

Meanwhile, Crockett has mainly focused on taking on Donald Trump, who is, in fact, not running for Texas’s open Senate seat and will, unfortunately, still be the President.

Talarico is not accepting any corporate PAC money and has never taken money from tech bro cryptocurrency companies. This is a welcome change from his last term in the TX House, where he was Scrooge McDucking (reveling in the riches) into Miriam Adelson’s Casino-Israel Lobby money. On the campaign trail, he has mentioned conditional military aid to Israel, but only for “offensive” weapons, not “defensive” weapons.

Crockett, while in Congress, has taken similar positions and voted for military aid to Israel. For reference, even Veronica Escobar has signed on to the Block the Bombs Act, which Representative Crockett has not. With recent efforts by SADSA city council members to rein in data centers, it doesn’t make much sense to vote for a candidate like Crockett, who has taken money from companies driving the increase of data centers. And yet, Congresswoman Jasmine Crockett’s vibe is good, and her name recognition is high. She can excite the base of the democratic party, which she’s hoping is all she needs to win.

The thing is, anyone who claims there’s one way to win a statewide race in Texas is lying. No one really knows what will win, because it has been so long. Everything is just theory until it’s done. Whether it’s winning over independents with Talarico or exciting the base with Crockett, both candidates are facing an uphill battle. The good news is that at least neither of these candidates is Colin Allred, who luckily has been keeping himself very quiet…

U.S. CONGRESSIONAL REPRESENTATIVES

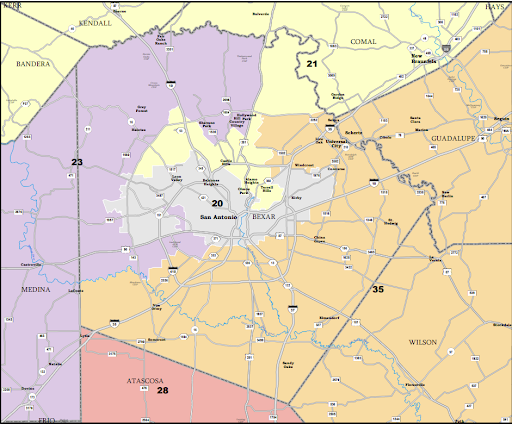

New Bexar County Congressional Map

June 9, 2025: At the behest of President Trump, Texas Governor Greg Abbott called for a special session of the Texas legislature to discuss redistricting.

August 29: Gov. Abbott signed new congressional maps into law.

November 18: A federal court in El Paso, Texas, ruled that the map constituted a racial gerrymander, a ruling that would have stopped the map from being used for the 2026 midterms.

November 21: The U.S. Supreme Court approved a request filed by Texas to temporarily block the lower court ruling.

December 4: Supreme Court stayed the District Court ruling in a 6-3 decision that allows Texas to use the map in 2026.

United States Representative, District 20

Recommendation: Joaquin Castro

Background: In recent months, Representative Joaquin Castro has mightily met the moment. From his work freeing Liam Conejo Ramos from ICE custody to opposing unconditional military aid to Israel, the ranking Democrat of the House Foreign Affairs Committee has earned our support. We’re also encouraged by Rep. Castro’s outreach to our local DSA electeds and hope he and his staff continue to communicate with local organizers. If Democrats take back the House, and the off chance anyone from Castro’s office reads this, we hope you’ll utilize the work of Progressive International once you become chair of the Western Hemisphere Subcommittee.

United States Representative, District 21

No Recommendation

Background: Kristin Hook is the likely frontrunner for District 21. Hook, a former union leader of IFPTE Local 1921, is endorsed by the San Antonio and Texas AFL-CIO and previously ran for this seat in 2024. New on the scene is Regina Vanburg, who supports Medicare For All, a Green New Deal, and an “everyone economy.” She’s also taking big swings at data centers and AI, which could wreak havoc on the Hill Country. Unfortunately, we’re unsure of her field campaign, and the fundraising lags behind Hook. Chip Roy is moving on from voting to block the release of the Epstein files to running for state Attorney General, but the district is still Trump +60% and will be an uphill battle no matter who comes out of the primary. Both Vanburg and Hook would be well-positioned to take them on.

United States Representative, District 23

No Recommendation

Background: TX-23 will be a slog for whoever comes out on top in the Democratic primary. Katy Padilla Stout is the likely frontrunner. She’s a former Northside Elementary Teacher and has collected several endorsements to put her campaign in a good spot against former TX-23 candidate Santos Limon. However, the rhetoric in this primary is moving further and further towards the Right at the top. Meanwhile, Bruce Richardson rocks and is certainly worth throwing your vote to if the candidate is just moving on to get wrecked by Tony Gonzalez.

United States Representative, District 28

Bye Henry Cuellar

Background: This district no longer includes any part of Bexar County after republicans redistricted. Good riddance. Bye-bye Henry!

United States Representative, District 35

No Recommendation

Background: This is one of the congressional districts that republicans flipped during the most recent redistricting. This district used to stretch from San Antonio to Austin but now encompasses the Southeast portions of Bexar County and extends into both Guadalupe Co., Wilson Co. and beyond. Both John Lira and Johnny Garcia were endorsed by the San Antonio and Texas AFL-CIO, but Johnny Garcia has also racked up endorsements from foes Nelson Wolff and ‘Blue Dog PAC,’ whose members have mostly spent the past two years trying to get more Republican. Meanwhile, John Lira has been endorsed by DSA member and District 6 Councilmember Ric Galvan and appears to have adopted the Affordability agenda front and center. If the race comes down to Garcia vs Lira, you’re likely in better hands with Lira. However, Missions and Spurs season ticket holder Maureen Galindo is also running in this race and is the more pious vote. Maureen previously ran in City Council District 1, where she received 2.5% of the vote, although her anti-corruption message is likely to land better with Wilson County voters in a congressional race.

STATE RACES

-

No Recommendation

Background: State Representative Gina Hinojosa (Austin) is the runaway favorite to be the standard-bearer for the Democratic Party’s latest attempt to oust Republican Governor Greg Abbott. There is a City Council’s worth of people running for the nomination. It’s very possible that she could avoid a runoff.

Hinojosa isn’t afraid to yell at republicans and was a leader in the fight against school vouchers. She has been good on public school and labor issues at the state level. She used to be president of the Austin ISD school board and is endorsed by the Texas AFL-CIO. But the reality is that Greg Abbott has endless money, and it seems all the Democratic money is flowing up to the US Senate race.

-

Recommendation: Marcos Vélez

Background: State Representative Vikki Goodwin (Austin), whose slogan is “A Good Win for Texas,” will most likely be the Democratic nominee for Lt. Governor. Her slogan is the only good thing about her campaign. But hey, the democrats had to run somebody. Marcos Vélez is also running, and surrogates have been making commotion on The Everything App on his behalf. Marcos Vélez is endorsed by the Texas AFL-CIO. In the endorsement interview by the Houston Chronicle, he didn't know who his state representative or state senator is. That’s strange considering the lieutenant governor presides over the state senate, but it’s also cool because who cares anyway?

-

No Recommendation

Background: This is a very polite fight between State Senator Nathan Johnson (Dallas) and Joe Jaworski (Galveston). You might recognize Jaworski’s name, as he has run for this seat previously. Both of these candidates are underwhelming and haven’t been able to raise enough money to run a serious campaign. Johnson is at least endorsed by the Texas AFL-CIO.

-

No Recommendation

Background: State Senator Sarah Eckhardt (Austin) will probably win this primary election. She used to be the Travis County Judge and will do a good job in the role. Eckhardt is endorsed by the TX AFL-CIO. The Comptroller’s most exciting role (besides counting the money and collecting taxes) is managing the voucher program, which she is vehemently against. If anything, she can be a loose cannon, and it would be fun to watch her debate whoever wins the Republican primary. Savant Moore and Michael Lange are also on the ballot. They seem boring.

-

Recommendation: Jose Loya

Background: Candidates for this office include Jose Loya (Dumas) and Benjamin Flores (Bay City). Although neither of these candidates are particularly exciting, and therefore nobody is talking about this race, Loya has a great understanding of how this office could better help working class people. Loya wants to invest more in clean energy, protecting coastal lands, and utilizing leases to better support public education in Texas. The Alamo is currently undergoing a $550 million renovation that will be overseen by the GLO as well.

-

No Recommendation

Background: Clayton Tucker is running unopposed. He looks real good in a cowboy hat 🤠

-

No Recommendation

Background: State Representative Jon Rosenthal (Houston) is a nice man with a background in the oil and gas industry. He is running unopposed.

-

No Recommendation

Background: Senator Roland Gutierrez is running unopposed in the primary, but will have a tougher race in the General Election. Roland ran one of the most rhetorically impressive statewide campaigns in recent memory, and Republicans in office hope to punish him for it. Republican leadership, in particular, hated him after he yelled at Dan Patrick about gun control, which rocks and is also why Roland rocks.

-

No Recommendations

Background: Senator Zaffirini only represents about 30 people in Bexar County and has never missed a vote on the Texas Senate floor despite holding office since 1987. Zaffirini will keep this seat until she decides to step down or apparently misses a vote. Whichever comes first.

-

No Recommendations

Background: Senator Jose Menendez is running unopposed. He is good on public schools and LGBTQ issues #ally.

-

No Recommendation

Background: Rep. Trey Martinez Fisher (House District (HD) 116), Shelly Nickels (HD122), Zack Dunn (HD 121), Rep. Diego Bernal (HD 123), Kristian Carranza (HD 118), and Rep. Josey Garcia (HD 124) are all running unopposed in the primary. HD116, HD117, HD123, and HD124 are all strong Democrat districts.

-

No Recommendation

Background: Incumbent Philip Cortez is accepting money from charter schools, and he was one of the few Democrats who didn’t break quorum. If TX had any type of party structure whatsoever, the Dems would’ve found someone to primary him, but here we are. Robert Mihara is challenging Cortez and is endorsed by the Texas AFL-CIO, but could’ve hit the ground running much harder.

-

No Recommendation

Background: This seat is currently held by Elizabeth "(Lyin’) Liz" Campos and the San Antonio AFL-CIO has broken her brain. She has a primary opponent named Ryan Ayala, whom she absolutely does not like.

-

Recommendation: Jordan Brown

Background: In HD 120, we recommend Northside ISD special education teacher Jordan Brown, who is endorsed by DSA member and District 2 Councilman, Jalen McKee-Rodriguez, and organized labor. Jordan knows firsthand how charter schools laid the foundation for Abbott’s voucher program, which the incumbent Barbara Gervin Hawkins believes “will not destroy public education.” This is, of course, because Hawkins herself created and continues to profit from undermining public education through her charter school network much like the way her brother destroyed NBA defenses with his signature finger roll.

Brown understands our state legislative members can and should be doing more, not just in Austin, but across the district. Brown shares this vision with Bently Paiz, who is running as an open Democratic Socialist. Paiz lacks the polish necessary to push out such a powerful incumbent in Hawkins. Notably, Paiz was fired from Josey Garcia’s office, and then they had a public feud over Twitter. It has since been deleted, but Josey Garcia apologized by calling him a troll. We appreciate any candidate willing to publicly spat with their former boss.

The hope for this race is that it will head to a runoff. As both challengers are seeking our chapter’s endorsement, the best outcome is for everyone to coalesce around whomever ends up taking on Barbara Gervin Hawkins head on.

-

Recommendation: Adrian Reyna

Background: In HD 125, we recommend SAISD teacher Adrian Reyna, who is endorsed by DSA member and District 6 Councilman Ric Galvan. Adrian is a longtime member of the San Antonio Alliance of Teachers and Support Personnel and serves as one of their Vice-Presidents. Adrian’s campaign has built a strong coalition of movement groups, unions, and membership organizations to organize locally while the Lege is not in session. (He could’ve hit the progressive grand slam by tapping us for endorsement, especially considering our bona fides in the overlapping City Council District 6.) Adrian is also a current VIA Board member. In Austin, his experience would bring a much-needed voice for the San Antonio delegation when it comes to supporting public transit and policies that enable seniors’ ability to age in place.

SUPREME COURT AND COURT OF APPEALS

-

No Recommendation

Background: You should probably vote for Maggie Ellis.

-

No Recommendation

Background: You should probably vote for Kristen Hawkins.

-

No Recommendation

Background: There’s a pretty coordinated smear campaign against Meza, which rarely works well in local races.

-

No Recommendation

Background: Mary Lou Alvarez has previously been reprimanded by the State Commission on Judicial Conduct for being mean to Family and Protective Services employees, which doesn’t sound great. There have also been several cases overturned in Mary Lou’s Court, which again doesn’t sound great. She’s being challenged by Dinorah Diaz, who apparently also has a temper, which doesn’t sound great.

Disclaimer: Information on Judicial candidates is minimal, so vote at your own risk.

-

No Recommendation

Background: Incumbent Michael Mery created Bexar County’s first Mental Health Court, probably worth a vote since you likely don’t know anyone on this page anyway.

-

No Recommendation

Background: There’s a chance you know Stephanie Boyd from viral moments while livestreaming in her court, such as telling a young man that “he’ll be passed around for ramen noodles.” Moments like that weigh heavily in this race, where challenger Stephanie Franco is basically running a single-issue campaign to use more discretion during livestreams. While state law has now stepped in to stop the streaming of sensitive cases, Franco says Boyd has failed to do so. The good work of the Court is being completely overshadowed by poor decisions disguised as transparency.

-

No Recommendation

Background: Incumbent Marisa Flores is facing a challenge from former Judge Grace Ozomba, who, at least according to Lucy Adame-Clark, is awful to work for. Flores, at least, hasn’t been publicly reprimanded like several other Judges.

-

No Recommendation

Background: Both Marissa Giovenco and Ana Nelson Ochoa are former prosecutors, but Giovenco has also served as a defense attorney.

-

No Recommendation

Background: Incumbent Cruz Shaw appears to be doing fine.

COUNTY

-

No Recommendation

Background: There is a vicious primary fight underway between incumbent Judge Peter Sakai, who has been a major advocate of Project Marvel and the new displacement-causing San Antonio Missions stadium; and who also ruled to kill Paid Sick Leave, and former San Antonio Mayor Ron Nirenberg, who has also been a major advocate of Project Marvel and the new displacement-causing San Antonio Missions stadium; and led the effort to kill the possibility of a ceasefire resolution at city council over the genocide in Gaza.

Neither are friends to the labor movement outside of election cycles, and both are bankrolled by some of the worst people in town. We wouldn’t say there’s no difference between the two; it’s just that the difference is marginal outside of “governance.” Ron will likely look to expand the role the County plays in the life of San Antonians, while Sakai will likely continue working to undermine the San Antonio Housing Trust and take credit for former Trustee Sarah Sorensen and the Schools Our Students Deserve Coalition’s work. You’ll probably hear more about what’s going on at the Commissioners Court if Ron wins, but it’s fair to ask yourself if that’s a good thing.

-

Recommendation: Shannon Locke or Jim Bethke

Background: This is a crowded primary field of eight candidates vying for the seat currently filled by Joe Gonzales, who announced last summer that he would not seek re-election this go around. The race is likely to go to a runoff, and based on the member organizations that are backing Shannon Locke and Jim Bethke, they are worthy of your consideration at the ballot box.

As a former defender, Shannon Locke seeks to institute a community-based approach to the criminal justice system. On the campaign trail, he is the lone candidate who has adamantly stated that he would investigate ICE agents for any criminal wrongdoing. While the current District Attorney (DA) and other candidates in the race claim that it is not possible, a coalition of DAs led by Philly’s own Larry Krasner has launched a national coalition of aligned District Attorneys aptly named Fight Against Federal Overreach (F.A.F.O.). The coalition includes two Texas DAs: Jose Garza of Travis County and John Creuzot of Dallas County. With a City Council that is finally showing signs of life toward keeping our immigrant communities safe, and the recent lawsuit from Ken Paxton to nix Bexar County’s immigration legal defense fund, it seems only natural to put forth a District Attorney who can meet this moment.

Jim Bethke has earned the support of the Texas Organizing Project and Act4SA. These organizations have long been committed to the fight for criminal justice reform. We trust that their endorsements in this particular race mean that Bethke is committed to ending mass incarceration of our black and brown communities in San Antonio.

Hopefully, at least one of these two can coalesce enough support to end up in a May runoff.

-

No Recommendation

Background: All seats are unopposed.

-

Recommendation: Victoria Cruz

Background: Victoria previously worked in the children’s program at RAICES, where she specialized in advocating for unaccompanied minors in immigration deportation proceedings.

-

No Recommendation

Background: While we’re sure there are differences in how each of these three candidates will preside over this Court, it’s not clear in their campaign materials. Incumbent Jessica Gonzalez is a former republican, which may be more damning for her challengers to see little difference in campaign rhetoric.

-

No Recommendation

Background: Incumbent Cesar Garcia has presided over this civil court well, particularly through dismissing stale eviction and debt collection cases. He’s facing a challenge from Shannon Robert Salmon, who has interesting ideas for how to better utilize the court, but was a former prosecutor.

-

No Recommendation

Background: Incumbent Judge Yolanda Huff presides over the Mental Health Court, which has a serious backlog. Challenger Lauren Zamora currently works as a prosecutor in the District Attorney’s office and hopes to cut into that backlog. Zamora is certainly out hustling her opponent on the campaign trail. Whoever comes out of this race, we hope they will support the work of City and County officials in the creation of a Mental Health Diversion Center.

-

Recommendation: Alicia Perez

Background: We’re recommending San Antonio Stands co-founder, Alicia Perez, over suspended Judge Rosie Speedlin Gonzalez. Gonzalez has done admirable work in her Reflejo Court and is no doubt facing a bad-faith campaign attack, but good elected officials have been undone for less offensive acts. Ultimately, the good work of the Court cannot be undermined by the presiding Judge, and we believe Alicia Perez will continue to bring compassion to the Court.

-

No Recommendation

Background: The incumbent Judge, Carlo Key, might get his opponent removed from the ballot for living in Floresville, allegedly.

-

No Recommendation

Background: All seats are unopposed.

-

No Recommendation

Background: With 5 candidates running for District Clerk, 3 of which have strong campaigns, there’s a high likelihood this seat will go to a runoff. Elva Abundis Esparza has received the AFL-CIO endorsement and has worked in and out of the City and County since 2003. Chris Castillo narrowly missed victory in 2022 where she lost to now incumbent Gloria Martinez. Monica Alcantara, former Chair of the Democratic Party is also running for some reason.

-

No Recommendation

Background: Lucy Adame-Clark is running for what she’s said is her last term as County Clerk. She has done a fine enough job in the position for what it is.

-

No Recommendation

Background: Justin Rodriguez is running unopposed.

-

No Recommendation

Background: Tommy Calvert, Jr. is running unopposed.

-

Justice of the Peace is an incredibly important seat—these elected officials hear eviction and other landlord and tenant cases, truancy cases, some Class C misdemeanors (think fine-only offenses), and civil cases that involve less than $20,000.

-

No Recommendation

Background: Both candidates are actively campaigning in the community, showing their dedication to the election process. Neither stands out, although Carlos Quezada is endorsed by the San Antonio AFL-CIO.

-

No Recommendation

Background: The three candidates in the race have similar responses to how they would manage the office in their SA Report profiles. It should be known that Anna Campos ran as a Republican for a Texas House seat in 2021.

-

No Recommendation

Background: Michelle Lowe Solis is running unopposed.

-

Precinct Chairs organize voters in their precinct. Little information is available for these candidates. Please look up your precinct to determine if you are voting in this election by visiting the Who Represents Me page on the Bexar County Elections website.

-

No Recommendation

-

No Recommendation

-

No Recommendation

-

No Recommendation

-

No Recommendation

-

No Recommendation

DEMOCRATIC PARTY PROPOSITIONS

The Democratic Party of Texas has placed non-binding propositions (opinion polls/surveys) on the primary ballot. These are meant to gauge voter sentiment and may help shape party platforms or future legislative priorities. Each is phrased as a “Survey” with YES or NO.

We know most candidates running on the Democratic ticket lean centrist, and few self-classify as progressives. We aren’t super hopeful that these candidates will push a socialist agenda, but it doesn’t hurt to vote YES. The background portion in this section expresses our politics. Joining DSA is the best way to fight for democratic socialism and get involved in building working-class power in the United States.

Texas should expand Medicaid and ensure access to affordable healthcare for all.

Recommendation: YES

Background: We need a healthcare system that prioritizes the health of working-class Americans over the profits of insurance companies and their billionaire executives. We need a single, universal system with comprehensive coverage that is free at the point of service.

Texans should support humane and dignified immigration policies and pathways to citizenship.

Recommendation: YES

Background: Our organization advocates for an open borders approach, calling for the abolition of ICE and the immediate end to all immigrant detentions and deportations. We support full amnesty for all undocumented immigrants, the right to free movement, and access to social services regardless of status.

Texans should have the right to make their own healthcare decisions, including reproductive rights.

Recommendation: YES

Background: We are longtime supporters of a single-payer Medicare for All system that allows patients to choose their own doctors, hospitals, and providers, without being restricted by insurance company networks or high costs. DSA explicitly supports reproductive justice, asserting that individuals should have the ability to make their own decisions regarding reproductive health.

Texas should address the state’s housing crisis in affordability and access in both urban and rural communities.

Recommendation: YES

Background: Social housing is when people live where we want, with whom we want, and how we want -- to the extent that we can imagine using all available resources through a democratic process. The immediate aim of a socialist movement in housing should be to build powerful organizations of tenants.

Texas should fund all public schools at the same per-pupil rate as the national average.

Recommendation: YES

Background: We organize and advocate for robust, fully funded public education, viewing it as a public good that should be protected from privatization. We support taxing the wealthy to heavily invest in public schools, aiming to end funding gaps, raise teacher wages, reduce class sizes, and expand community-focused school services.

Secure online voter registration should be accessible to all eligible Texas residents.

Recommendation: YES

Background: DSA advocates for expansive, universal voting rights, viewing them as essential to achieving economic and political democracy. Our platform focuses on eliminating barriers to voting, restoring rights to disenfranchised individuals, ensuring fair representation, and countering efforts to limit voter access.

Texas should have a clean and healthy environment that includes water, air, and biodiversity.

Recommendation: YES

Background: DSA advocates for a radical Green New Deal that fully decarbonizes the economy, aiming for a healthy environment, clean air, water, and robust biodiversity through ecosocialist policies. We prioritize decommodifying essential resources like clean water, shifting away from industrial agriculture to restore soil and protect biodiversity, and centering environmental justice for frontline communities.

Texas must preserve the state's natural, cultural, scenic, and recreational resources.

Recommendation: YES

Background: DSA supports improving and expanding public services, including access to outdoor recreation, as a way to "decommodify" survival and improve quality of life. This includes supporting community-led conservation. DSA emphasizes keeping public lands and natural resources out of the hands of corporate interests.

We support reinvesting in and expanding national parks, forests, and other public lands to preserve them for future generations. We also recognize that environmental protection must honor Indigenous land rights and self-determination, acknowledging that many natural resources are on unceded Indigenous territories.

Texas should legalize cannabis for adults and automatically expunge criminal records for past low-level cannabis offenses.

Recommendation: YES

Background: We advocate for the full legalization of cannabis, the expungement of past convictions for low-level offenses, and ending the "war on drugs".

Texas should raise salaries to at least the national average and should provide a cost-of-living increase based on the national Consumer Price Index every two years to current/retired school and state employees.

Recommendation: YES

Background: DSA supports robust wage increases, cost-of-living adjustments, and strengthened labor protections for all workers, including state employees.

Texas should ban racially motivated redistricting, ban mid-decade redistricting, and create a non-partisan redistricting board to redraw lines every 10 years.

Recommendation: YES

Background: We advocate and fight for fair maps while pragmatically endorsing temporary, aggressive measures to counter right-wing efforts to consolidate power through gerrymandering.

The Working Class should be eligible for greater federal income tax relief and have their tax burden fairly shifted onto the wealthiest.

Recommendation: YES

Background: DSA calls for taxing the richest earners, large inheritances, and corporations to fund social programs, including a proposed "wealth tax" on the ultra-wealthy. This is a mechanism to reverse extreme inequality and reallocate resources from capital to labor.

Texas should expand accessible public transportation opportunities in rural and urban communities so residents can get to their workplaces, schools, and healthcare.

Recommendation: YES

Background: The expansion of public transport is directly tied to the Green New Deal framework, which aims to reduce carbon emissions while improving accessibility for working-class communities. Public transit is a critical public service, a right, and a necessary alternative to car-dependent, polluting infrastructure.

Texas should prevent individuals with a history of domestic abuse from purchasing firearms by implementing “red flag” laws.

Recommendation: YES

Background: Gun violence is a national emergency, and we advocate for strict gun control, including proposals to repeal the Second Amendment, prohibit the manufacture/transport of semi-automatic weapons, and end police militarization. Individual gun ownership is not a constitutional right. We should focus on dismantling the root causes of violence, such as poverty and inequality, while building trust and support within communities.